Why Converting Less Can Save You Thousands in 2026

Published on: 27/02/2026

Learn why converting less to a Roth IRA in 2026 can save thousands. Discover how West Virginia tax laws, Social Security, and Medicare "cliffs" impact your retirement.

Tax Discipline

The Retirement Tax Trap: Why Your "Average" Tax Rate Is Lying to You

Published on: 21/02/2026

Think you're in a low tax bracket? Think again. Discover how the "Tax Torpedo" hits retirees and why your average tax rate isn't the full story.

Tax Discipline

The RMD Tax Bomb: How to Defuse Your IRA Using a QLAC and FIA Strategy

Published on: 27/01/2026

Learn how to use a QLAC and FIA to shrink your RMDs, avoid the 2026 IRMAA Medicare cliff, and automate your taxes. Defuse your retirement tax bomb today.

Lifetime IncomeTax Discipline

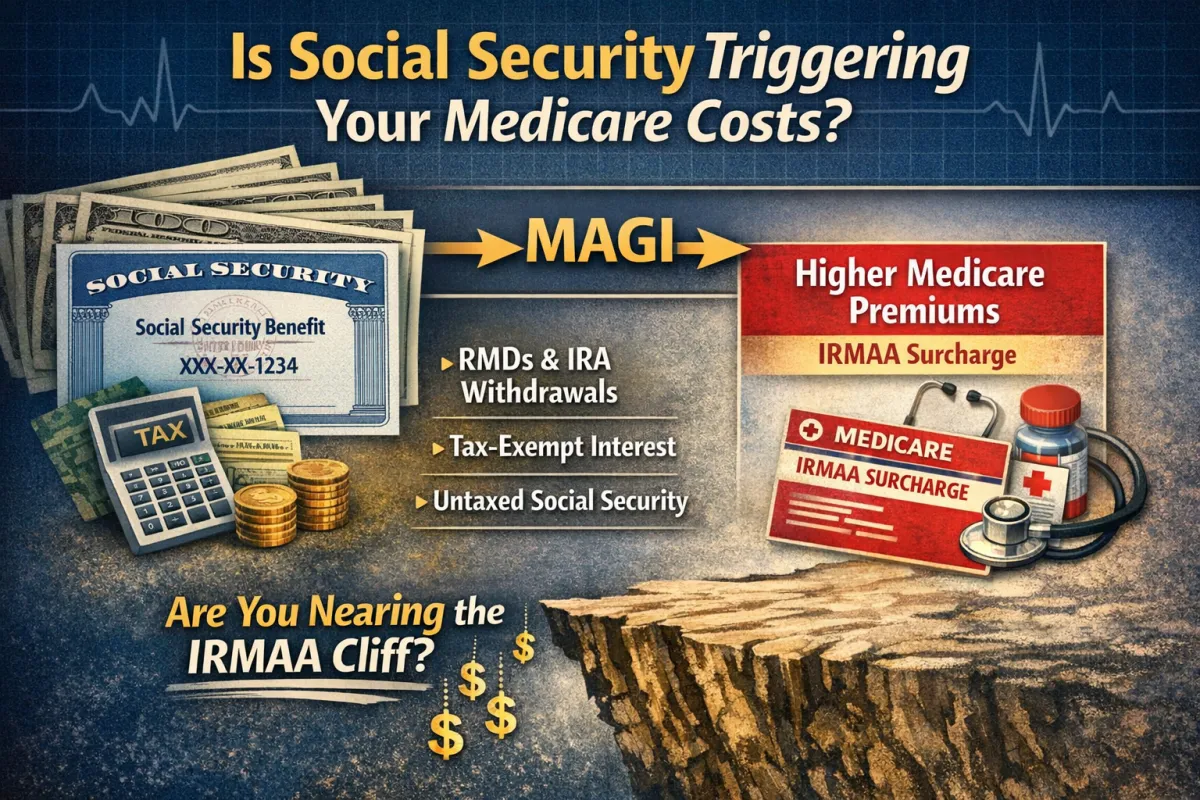

The Social Security Trap: How High Income Impacts Your Medicare Costs

Published on: 24/01/2026

Think your Social Security is safe from taxes? For high-net-worth couples.Social Security can trigger expensive Medicare IRMAA surcharges. Learn how your MAGI impacts your premiums and how to protect your benefits

Tax Discipline