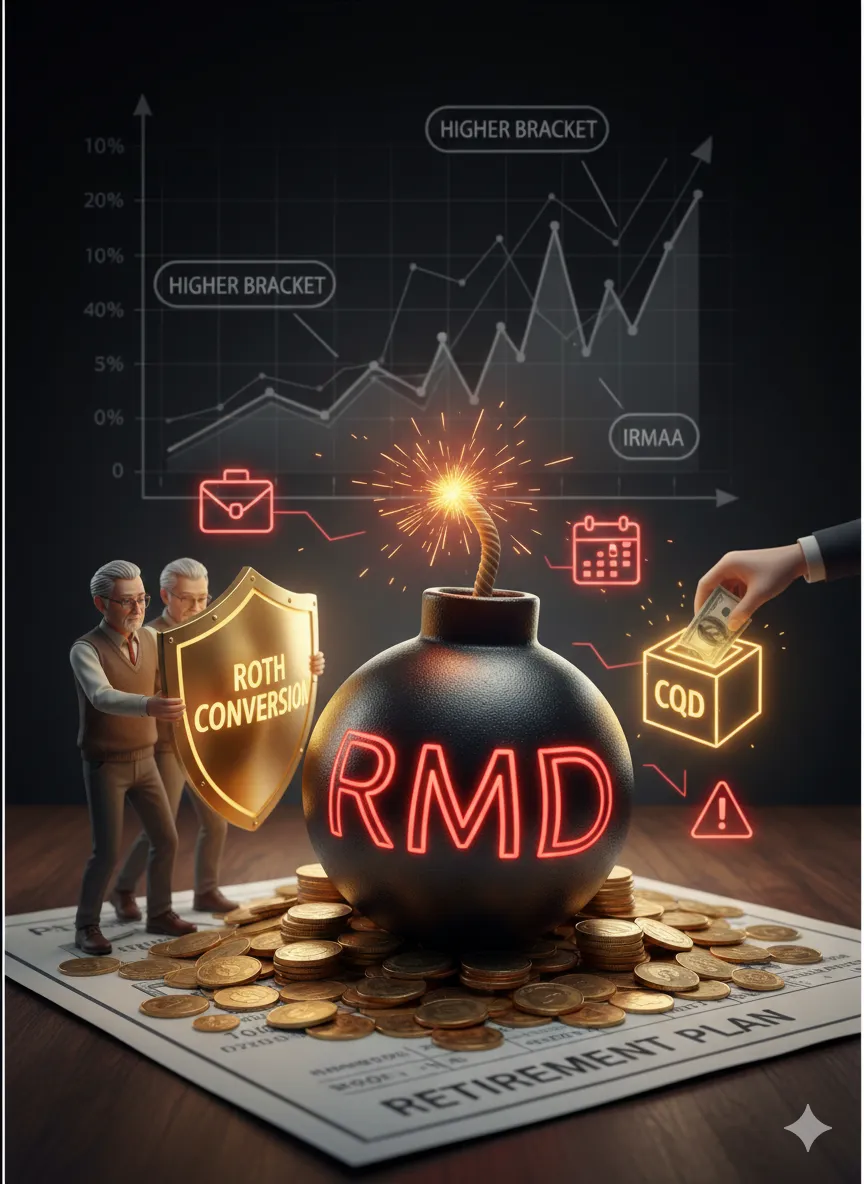

The RMD Tax Trap: How Unplanned Withdrawals Can Ruin Your Retirement Introduction: The Savings Success That Becomes a Problem

Introduction: The Savings Success That Becomes a Problem

You did the hard work: you saved diligently into your Traditional IRA and 401(k) for decades, taking the tax deduction every year. Congratulations!

But now, success comes with a compulsory twist: the Required Minimum Distribution (RMD). Once you reach age 73 (or later, depending on your birth year), the IRS mandates that you start withdrawing a minimum amount from most pre-tax retirement accounts, whether you need the money or not.

These RMDs are taxed as ordinary income, and if you fail to take them, the penalty is a hefty 25% excise tax on the amount that should have been withdrawn.

The Three Tax Bombs Triggered by RMDs

The RMD is more than just a mandatory withdrawal—it’s a financial ripple effect that can trigger hidden costs across your entire retirement plan.

1.The Higher Tax Bracket Surprise: Large, mandatory RMDs are simply added to your other sources of income (pensions, Social Security, taxable investments). This sudden surge of income can easily push you into a higher federal tax bracket than you expected, meaning less money stays in your pocket.

2.The Medicare Premium Surcharge (IRMAA): This is one of the most overlooked costs. The Income-Related Monthly Adjustment Amount (IRMAA) is an increased premium for Medicare Parts B and D that kicks in when your modified adjusted gross income (MAGI) exceeds certain limits. The worst part? Medicare looks back two years at your income. An RMD can unintentionally trigger these higher Medicare premiums two years later, costing you thousands annually.

3.The Social Security Tax Torpedo: For many retirees, RMDs push your income over the threshold where your Social Security benefits become taxable. Up to 85% of your Social Security can be taxed, and a larger RMD can be the trigger that makes a significant portion of your benefits subject to tax.

How to Defuse the RMD Tax Trap: The Power of Planning

The biggest mistake is waiting until you are 73 to address RMDs. Proactive tax planning can minimize the damage.

●Strategy 1: Roth Conversions: Converting portions of your Traditional IRA/401(k) to a Roth IRA in your lower-income years (often your 60s) reduces the balance subject to future RMDs. This gives you tax-free income later on.

●Strategy 2: Qualified Charitable Distributions (QCDs): Once you hit age 70½, you can use a QCD to satisfy some or all of your RMD by sending the money directly to a qualified charity. This money is never counted as taxable income.

●Strategy 3: Tax Diversification (IUL/Annuities): Accounts like Indexed Universal Life (IUL) policies and certain annuities do not have RMDs, giving you a pool of assets you control entirely.

Call to Action: Don't let the IRS write the script for your retirement.