The "Wrong Side of the Ledger Why Retirees Are Overpaying on Investment Fees?

By Dora Wysocki

If you have been diligently saving in a 401(k) or traditional IRA, you might be an unwitting partner in a lopsided deal. Most local investors see their retirement account as a single, solid number. However, if that account is pre-tax, a significant portion of it doesn’t actually belong to you—it belongs to the IRS.

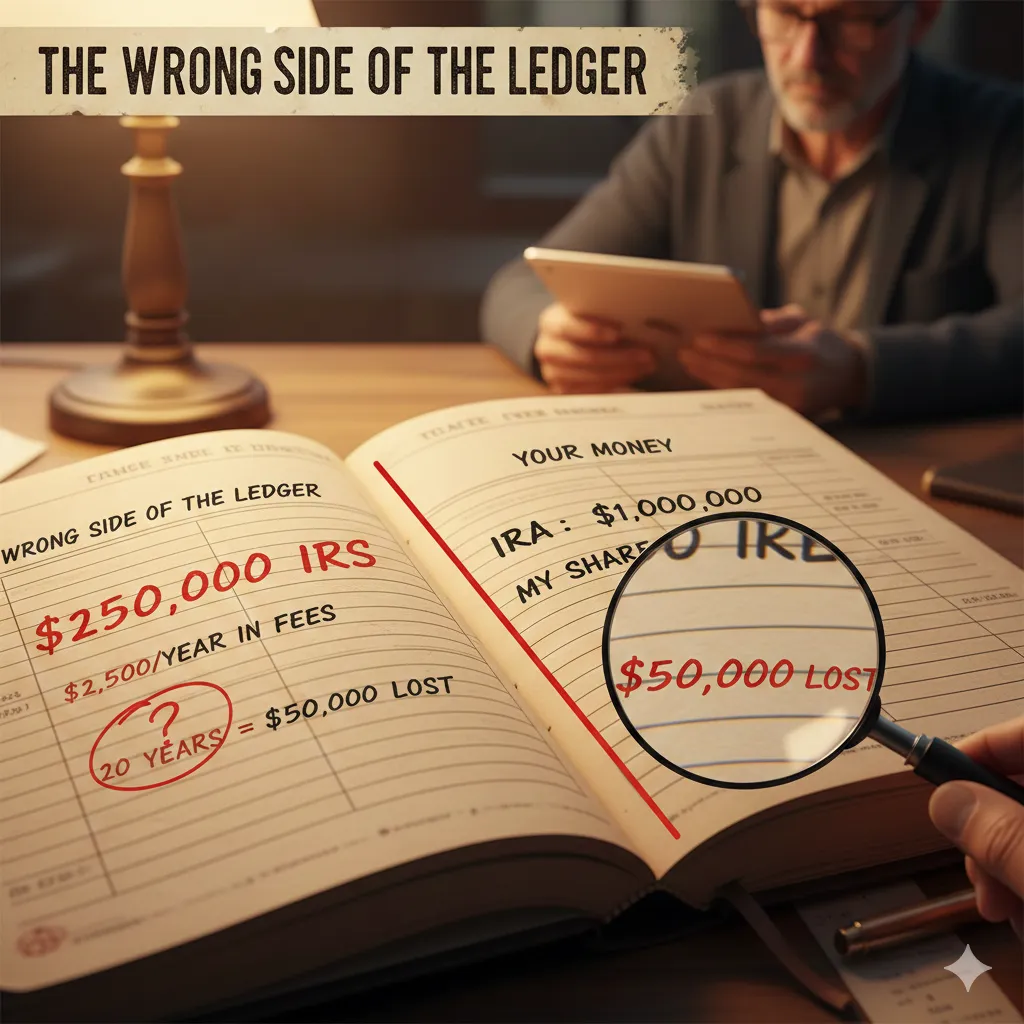

The problem? You are likely paying 100% of the management fees on an account you only own part of. In the financial world, we call this the "Wrong Side of the Ledger."

The Case of the $50,000 "Ghost Fee"

Let’s look at a common scenario we see here. Meet "Tom," a hypothetical investor who has worked hard to build a $1,000,000 IRA.

Tom is in a 25% tax bracket. This means that while his statement says $1M, $250,000 of that is a deferred tax liability—effectively the government’s future "cut."

The Hidden Inefficiency: Tom pays a standard 1% advisory fee ($10,000 per year).

The Calculation: Because Tom pays the fee on the entire balance, he is paying $2,500 every single year just to manage the IRS’s portion of the money.

The 20-Year Impact: Over a typical retirement span, Tom will have lost $50,000 in fees to the "wrong side of the ledger."

This isn't just a math error; it’s a drain on your lifestyle that could have been spent on travel, family, or local legacy building.

Why This Matters for Retirees

Fees are often the "silent killer" of a retirement plan. When you combine investment fees with the specific tax landscape, the erosion of your wealth can accelerate. Many retirees are never shown the math on how tax-efficient distribution strategies—such as Roth conversions or strategic asset location—can move money back to the "right" side of the ledger where you aren't paying rent on money you don't own.

Stop Subsidizing the Government’s Investment Fees

We specialize in helping families in identify these hidden leaks. Our goal is to ensure that every dollar you pay in fees is working exclusively for your future, not the government’s.

Are you paying "Ghost Fees" on your retirement? Don't let your hard-earned savings be depleted by the wrong side of the ledger. We offer a complimentary Fee & Tax Audit for local residents to help you see exactly where your money is going.

The information provided in this post is for educational and informational purposes only and should not be construed as specific financial, investment, or tax advice. I am not a licensed financial advisor, CPA, or tax professional. The "Tom" case study is a hypothetical illustration used to explain a financial concept; actual results will vary depending on individual circumstances, market conditions, and current tax laws. You should consult with a qualified professional before making any decisions regarding your retirement accounts or investment strategy.